Ten Questions

With a goal of helping to recognize our attitudes toward God and government, we briefly raise ten questions in our CD “Ten Financial Gifts You Can Give Your Children… Even in Tough Economic Times”. In that message, we do not answer the questions — we simply raise them as food for thought and leave them as an exercise for the listener. This article attempts to briefly provide our answers to those ten questions.

I would encourage you to carefully and prayerfully consider, study, and answer these questions for your own families. As our nation continues its economic descent, the principles included in your answers can help guide your family through the troubled days ahead.

What should we render to Caesar? What should we not?

When pressed on whether it was lawful to give tribute to Caesar – to pay taxes to the secular government – Jesus presented two key points of information. First, He asked His listeners to identify whose image and superscription was on the coin. They said simply, “Caesar’s.” Second, He gave the principle: “Render therefore unto Caesar the things which be Caesar’s, and unto God the things which be God’s.” This instruction is recorded in three of the four gospels (Luke 20:20-26, Matthew 15-22, Mark 12:13-17).

What had Caesar’s image? The currency of the day. So, taxation itself is lawful. What has God’s image? From Scripture, we see that people – made in the image of God – bear His image. This is recorded in Genesis 1:27 and reaffirmed in Genesis 9:6 where civil government was instituted with a prescription for punishing evildoers.

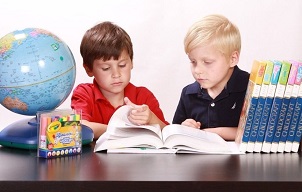

And how are we to bear God’s superscription — His words? On what should they be written? Psalm 119:11 tells us, “Thy word have I hid in mine heart, that I might not sin against thee.” Mankind, being a special creation of God, bears the image of God and should hide His Word in their hearts. People – including our children – are not the property of the state; therefore the state has no legitimate claim over them. Rather than render our children to the statist schools, we should embrace our God-given roles as parents and train them ourselves (Deuteronomy 6:4-9). If circumstances prevent that, we should seek a private school that will train our children in line with God’s principles.

At what point does more taxation become an outgrowth of larceny, greed, and covetousness?

When a government extracts more from taxpayers than is needed to fund legitimate government expenditures — those allowed by its foundational documents and not violating God’s commandments — it has crossed into using governmental authority to execute theft on behalf of those coveting and then receiving the goods of others. That is to say, those receiving largesse from the government are not reaching directly into the taxpayers’ pockets to steal; rather, they are using the government as an intermediary to do the stealing and distribution on their behalf.

What are the legitimate functions of government? According to Scripture, the basic purposes of government are to encourage good and to punish evildoers — and this must be done in a way that doesn’t violate God’s commandments. The role of government is dealt with more fully below in the questions about the federal and state governments and their relationships to the needs of individuals.

A few additional points to consider… When Samuel was warning Israel against moving from a system of judges toward having a king, he warned that the king would take a tenth of their seed and produce (I Samuel 8:15). Even at the time of the upcoming famine in Egypt, Pharaoh only took twenty percent in preparation for the seven lean years (Genesis 41:34). And when King Ahab coveted Naboth’s vineyard, even he realized that he could not legitimately seize property which belonged to another (I Kings 21:1-16). Take just a moment and compare those incidents with governments in our modern era… When the people were warned against losing 10% to taxation, when a pagan monarch takes only 20% in a time of crisis, and when one of the most notorious kings in the Bible maintains a semblance of respect for private property, it really points to how far we have fallen as a once-free people.

Should other people be required to pay for my family’s food, shelter, education, healthcare, amenities, and retirement?

We are instructed in Scripture to show compassion on our brother in need (I John 3:17), to have pity on the poor and thereby lend to the Lord (Proverbs 19:17), and to do good to all men – especially those of the household of faith (Galatians 6:10). Caring for our brethren in need was to be one of those good works the world could see and then glorify our Father in heaven (Matthew 5:16). In all these instances, however, the charity was done without compulsion; it was an act of love in service to the Father, seeking to do His will.

In addition to having compassion, however, we are to use discernment. There is a difference between the poor who are working hard yet still poor, and the slothful who sit idly and expect to be fed. We see repeatedly in Scripture where the idle soul shall suffer hunger (Proverbs 19:15), where the slothful won’t even bring his hand to his mouth to feed himself (Proverbs 19:24), and where those who will not work should not eat (II Thessalonians 3:10). At the individual level, working in our own communities, we can see people’s habits of work and stewardship, and thereby discern how to prioritize the resources we have available to help others.

When governments take by taxation and spread wealth from the “haves” to the “have-nots”, there is no discretion, no prioritization of the brethren, and no encouragement of the poor to work — there is simple subsidization of slothfulness. There is no scriptural case to be made for the government requiring anyone to pay for anything for anyone else. It is out of the government’s jurisdiction and stands in the way of people using the resources God has given them as He directs them to meet the needs of their community and reach out to others in love.

Should the rich pay more in taxes than the poor?

“Thou shalt not covet … any thing that is thy neighbor’s.” (Exodus 20:17) “Thou shalt not steal.” (Exodus 20:15) Even in only looking at the Ten Commandments, we can see that God respects private property rights — simply desiring the goods of another is a sin, even if no theft occurs. If you then take what belongs to another, that’s a second sin. If there was no private property, then neither coveting nor stealing would be sinful.

Much of modern politics is built upon what a majority of voters would like to see for expenditures, while assuming that someone else’s taxes will be high enough pay for it. Before the Sixteenth Amendment was ratified in 1913, there was no direct income tax; federal government expenses were paid primarily by tariffs on imported goods and occasionally by taxes levied upon the states.* As a result, federal expenses were vastly lower, as was federal power. Since the Sixteenth Amendment was passed and the federal income tax begun, it has become a tool for enshrining class conflict as a core of American life. That is, envy is encouraged, as the majority can vote for programs they cannot afford, simply because they can tax the rich at a higher rate to pay for them. The prevailing wisdom is that taking from the rich is okay, because they already “have more than they need”. This Marxist philosophy runs counter to Biblical thinking, but has proliferated in America since the early 1900’s.

In the Bible, we see uniformity in sharing expenses. In Exodus 30:12-16, God commands a half shekel atonement offering from each of the Israelites, none more, none less. In Numbers 7:11-88, the twelve tribes of Israel each offered a uniform amount of silver, gold, flour, and sacrificial animals. There was no difference between the large tribes or the small tribes, the rich or the poor — they gave equally.

Beginning at least as far back as Abraham in Genesis 14:18-20, the tithe established a uniform percentage of giving firstfruits to God. While the physical amounts given were not equal, the percentage was. There was not one rate for the poor and another for the rich; it was a flat 10%, with no deductions, exemptions, or special credits, like those the government uses to prefer one set of people — or their behaviors — over another.

As to whether the rich should pay more in taxes than the poor, the question would be completely unnecessary if we were to roll back the Sixteenth Amendment and return to funding the federal government by tariffs and an occasional tax apportioned among the states, as we did for more than half the lifetime of our country. This would have the additional benefit of shrinking government and thus restoring freedom. This would be the first option for me.

If we can’t yet go back to a tariffs-only funding model, my second choice for the interim would be a flat per-head tax. With such a system, everyone would have an equal share in government expenses, just as each person has an equal vote. It would also give people an equal incentive to hold expenses down and would, in fact, require that they be low enough that even the poorest among us could afford their shares. One person’s vote, one person’s share of legitimate government services, one person’s share of the bill.

As a third choice — and a distant third, at that — I would opt for a flat percentage that applies to everyone equally – not absolving the poor by having them pay nothing and not penalizing the rich by having them pay a higher percentage. Thus there is no incentive to earn less and get subsidized, and no disincentive from earning more and getting bumped into a higher tax bracket.

* One caveat – During the Civil War, there were ten years of an unconstitutional income tax on individuals.

If 51% of the people in this room vote to take your purse or wallet and divide its contents among themselves, does that make it right?

As we just saw in the answer above on the rich paying more than the poor in taxes, God established and recognizes private property rights, even including them in the Ten Commandments. Simply put, thou shalt not covet and thou shalt not steal. Whether taking one’s substance by violence (Proverbs 1:10-19) or by democratically voting and assuming control over another person’s purse, the end result is the same — coveting and then taking property from its rightful owners.

I would argue that the same principle applies regarding taxation, whether that is the income tax at the federal and state levels or the property tax at the local level.

That is — if 51% of the people desire to fund entitlements, certain medical procedures or medications, interventionist military occupations, leftist-leaning public schools, or other things you may find morally or Scripturally inexcusable (or simply unworthy of your hard-earned dollars), by what authority can that 51% appropriate your God-given substance and use it to fund those activities you oppose? They can seize it simply because we have lost much of our Christian heritage and have moved from being a God-honoring republic to becoming a secular democracy where mob-rule is lauded and exported around the world.

Just because the current system is legal does not make it right, and we should work within what legal means we have to help effect a restoration of a more God-honoring system of government. That may involve voting, lobbying legislators, educating others who may be ignorant of our heritage or Biblical principles, and raising the next generation of voters to carefully consider the size and scope of government from a Biblical worldview.

Continue with Ten Questions, Part 2

Copyright © 2014